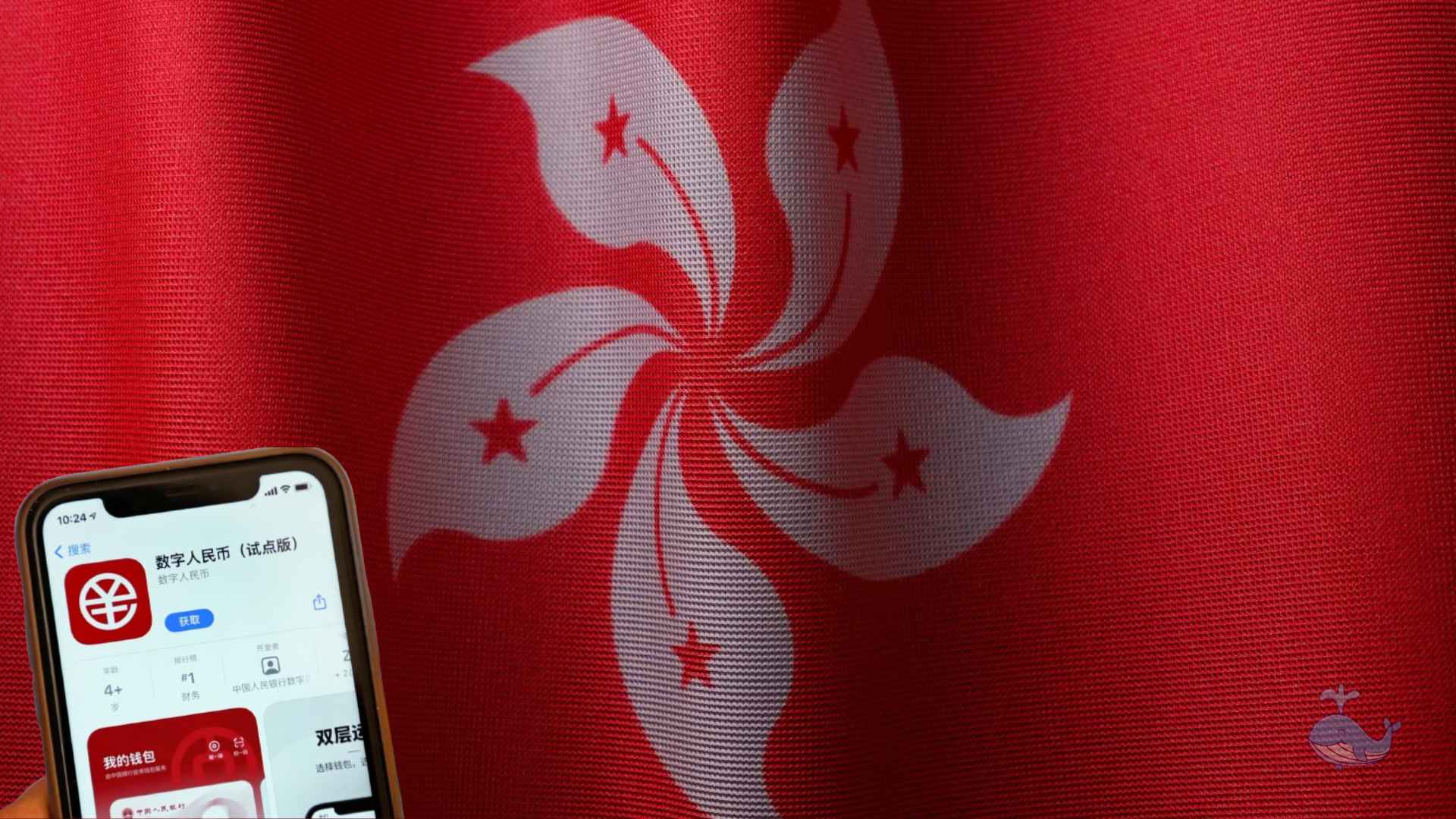

Hong Kong unveils Digital Yuan eCNY Personal Wallets for Cross border Payments

The Hong Kong Monetary Authority (HKMA) has announced the launch of digital yuan, also known as e-CNY wallets, for users in Hong Kong. e-CNY is the first digital currency issued by a major economy and a digital version of China's national currency, the renminbi, which is issued and backed by the country's central bank, the People's Bank of China (PBoC).

According to the press release published on the HKMA website on Friday, the Hong Kong authority and PBoC have advanced the e-CNY pilot program for cross-border payments.

The goal of the program is to broaden its scope and make it easier for residents of Hong Kong to facilitate the set-up and use of e-CNY wallets and top them up via the Faster Payment System (FPS).

The official statement stated that users will be able to create e-CNY personal wallets in Hong Kong with just their personal mobile phone numbers. Furthermore, users can use the FPS to top off their e-CNY wallets at 17 retail banks in Hong Kong. However, the e-CNY wallet is limited to only cross-border payments between Hong Kong and the mainland, as person-to-person transfers within Hong Kong are not supported.

"We are delighted that Hong Kong, being the first place to conduct cross-border e-CNY piloting, has also become the first place outside the Mainland that enables the people in Hong Kong to set up e-CNY wallets locally," stated Mr. Eddie Yue, Chief Executive of the HKMA.

Users can now top up their e-CNY wallets whenever and wherever they want without having to open a Mainland bank account, thanks to the expansion of the e-CNY pilot program in Hong Kong and leveraging FPS's 24x7 operating hours and real-time transfer advantages. This makes it easier for Hong Kong residents to make merchant payments on the mainland, Eddie added.

“We'll keep working closely with the PBoC to gradually help expand the applications of e-CNY, improve the features of the wallet, and intensify our efforts to promote the acceptance of e-CNY by more retail establishments in both locations.”

The announcement of the e-CNY pilot in Hong Kong is one of the six measures announced by the PBoC earlier in January under the “three connection, three facilitation” initiative.

Hong Kong's distinguishing feature is that the e-CNY initiative on the mainland appears to be receiving more attention than the city’s homegrown central bank digital currency project, which is centered around the Hong Kong dollar.

The digital yuan was first researched in 2014. With the participation of businesses like Alibaba, Tencent, JD.com, Huawei, and UnionPay, the Chinese government had approved the development of digital yuan by 2017. Regarding technology, the digital yuan functions similarly to other digital currencies like Bitcoin since it is based on a digital ledger.

Disclaimer: This information should not be considered financial advice by any means. Please do your own research before making any investment decisions. The views in the articles are personal opinions only. Whale Insider is not responsible for any financial losses incurred.